Get Email Updates

Get an email the instant your dream home hits the market with your MyLogin account

Check out all Current South Florida Market Statistics Here! Find Days on Market, Closed Sales, Active Inventory, Median Sales Price, Mortgage Rates, and more for Palm Beach, Martin, St. Lucie, Broward, Indian River, and Miami-Dade!

The real estate market in general has slowed down from its torrid and unsustainable pandemic pace every month since April 2022. So, what to expect in the market and specifically in South Florida in 2023?

Here are 7 reasons why not to expect too much of a downturn.

And why 2023 might be a major opportunity to purchase and not just a pause in the market.

Ever since A/C was invented, people have flocked to Florida. Florida is now the fastest growing state in the country.

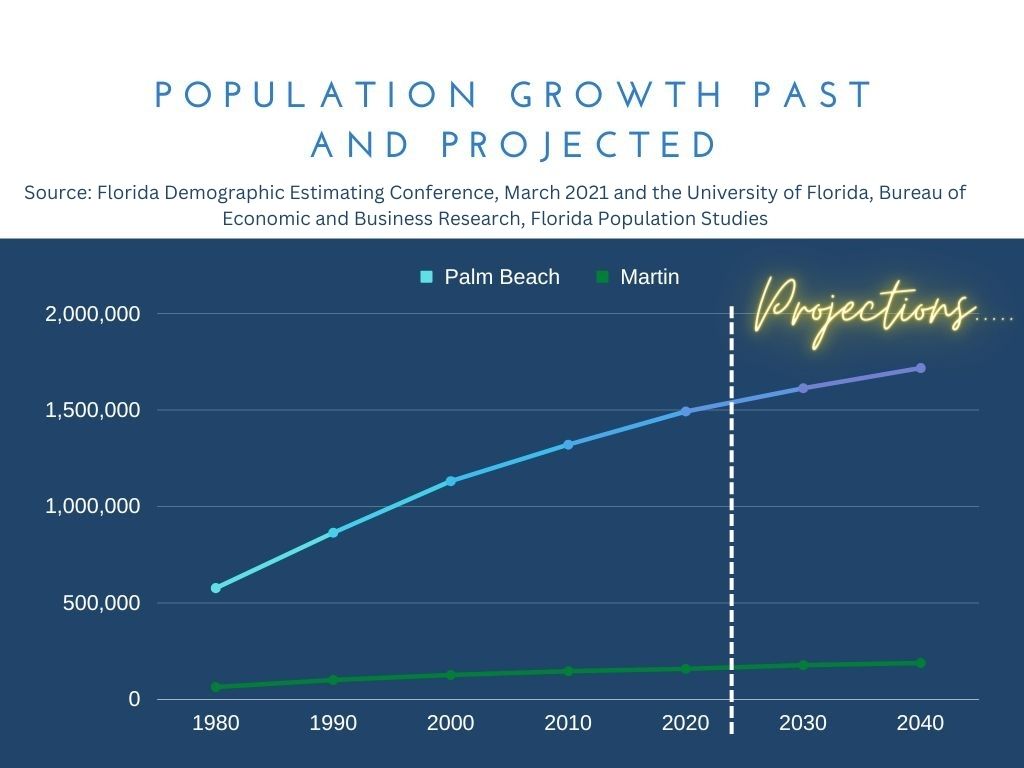

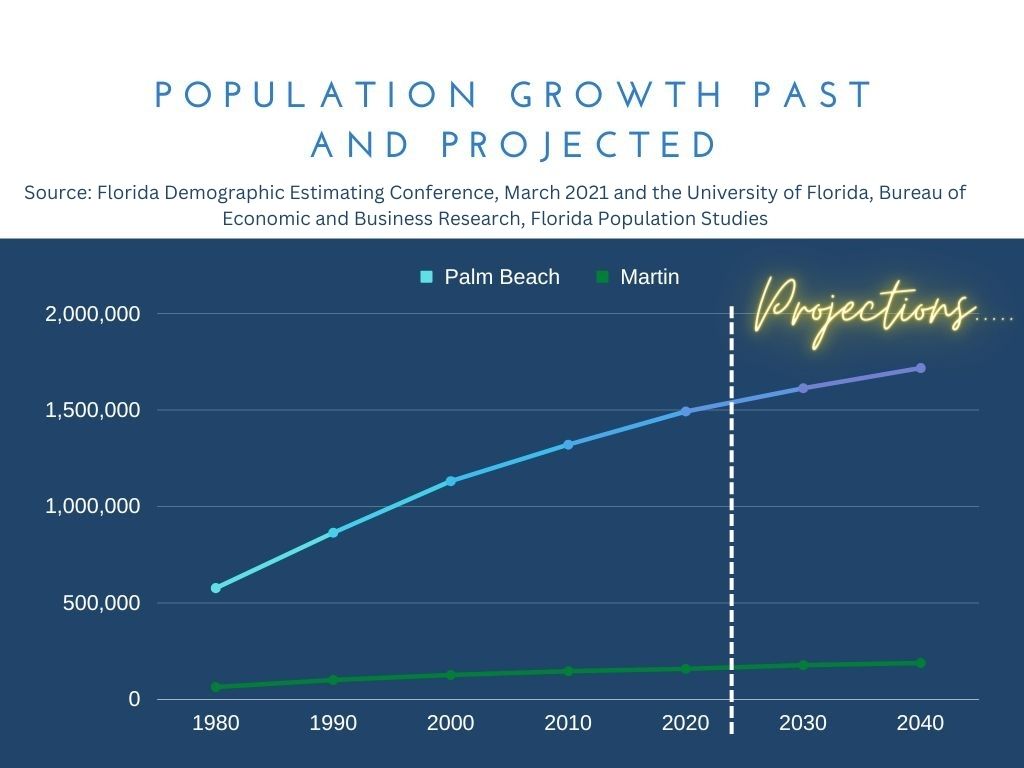

Palm Beach County is projected to net 7,500 households (2.5) 18,750 people a year each year over the next 10 years.

As the population has exploded over the past 40 years, the infrastructure of shopping, restaurants, culture, and schools has come with it. That has added to the draw and has made it easier for people to flock here even more. Not only is there 0% income tax, but homestead laws limit residential real tax estate jumps for full time residents (6 months and a day).

(Find out more about Closing Costs and Homesteading here.)

Builders have too much supply on hand. There are 8.6 months of supply of new homes at 11/2022 according to FRED. This needs to be in the 4-6 months area before builders are going to want to build. Plus, they have to compete with re-sales. New development mostly stopped in the 2nd quarter of 2022.

Locally though, the Palm Beaches is an entirely different story as there isn’t much in specs or land to even build on. By the time mid 2023 rolls around, there will be a shortage of new construction, leaving re-sales all by itself without giving buyers much choice of new builds.

Second, unlike the Big Short market of 2008, the unlimited amount of land east of 95/Turnpike is basically all gone. The pioneer phase of the market really ended during the pandemic. Lots of land still exists west of the Turnpike and into Martin County, but the amount of land left to build on is a 180-degree difference from 15 years prior.

The regulations shoring up the “big short” marketplace worked. Residents not only had to be good on paper but they earned low interest rates in the high 2’s, 3’s, and 4’s percent range.

Unemployment is low and even with a projected uptick in unemployment, we aren’t going to see much in the way of foreclosures or lots of movement of people who don’t want to move because of their low interest rate. Take a look at our article “Is Now a Good Time to Buy?”

My wife, Veronica Lichtenstein is a Licensed Mental Health Counselor and maybe she is the right one to ask but homeowners just aren’t wired to think the value of their home is going down with inflation. If there is 8% year over year inflation and prices have stayed stagnant then the value of your home really dropped 8%.

Prices are basically dropping without needing to have them lowered. If the market keeps prices even from 2022-2023 with 7-8% inflation, then we’ve really seen a drop in real estate prices of 15-16%. Basically, the market is bringing prices down automatically.

Inventory overall is still low and with current residents not wanting to move, it’s more “must-move” homeowners that are driving up the supply slowly. Prices though can change unequally. Homes that are A’s and B’s, meaning those that are newer or remodeled with the best floorplans, and excellent lot locations will still move quickly. The inventory that grows will be centered on the “problem child” homes. Expect more price fluctuation in fixer uppers.

The Fed moving so dramatically on interest rates is starting to lessen. ¾ increases have slowed to ½%. As inflation lessens, joblessness starts to go up (some of that will be fueled by less jobs to fill the lessening need for labor to build houses, materials, and after products needed. That should occur in second quarter 2023 as the rush of first quarters 2022 housing new construction starts are completed. Once inflation goes down, most financial analysts expect interest rates will follow.

A number of factors should take place by the fourth quarter 2023 or early 2024 to see the market move and prices jump. If rates fall into the mid 5’s, that along with portability of homestead exemption and some pent-up demand, should stimulate buyers into wanting to move.

Furthermore, real inflation over a 24-month period along with not much or even a slight drop in prices will have created a real 15-20% lowering of home values.

Now go back to points 1 (demand) & 2 (supply) above. An increase of demand along with lower supply and late quarter 2023 or early 2024 could see prices jump dramatically. 2024 is when we will really see lots of possible double-digit movement because of the seasonality of when most Buyers are ready to purchase.

Plus 2 years (2022 saw 2012 levels of transactions) of less than normal transactions – see our full 5-year market stats comparisons here) will have taken its toll.

Across the country, the existing home inventory over the past 6 years in the United States is still historically low. We are still nearly 50% below inventory from 2106. And it’s been going down further. We just can’t build enough new homes to keep up with demand. See 10 years of historial existing inventory. Investors & Airbnb are taking some of those resales away from would be homebuyers forever.

Now take the amount of people already here and those who are coming, that level of inaction is not sustainable. Escalation Clauses, Bidding Wars, and Love Letters 💕 we saw during the pandemic might come roaring back as the laws of increased demand of people moving here, limited supply, lower rates, repressed pricing over 2 years , and lack of new construction all occur not too far from today.

It’s impossible for buyers and sellers to perfectly time a market. We knew toward the end of 2021 that must buyers were getting in bidding wars and paying 10-15% over ask. Some Sellers who waited to sell regretted not putting their home on the market. Buyers at some point will feel the same as its difficult to time when a bottom hits. This is why purchasing while there is choice and negotiation room (you can always re-finance if not cash) might make 2023 an excellent time to take advantage of “The Pause”.

Jeff Lichtenstein is owner and broker of Echo Fine Properties, a luxury real estate brokerage selling real estate in Jupiter and homes in Palm Beach Gardens, Florida. He has 20 years of real estate experience, has closed over 1,000 transactions, and manages over 70 agents in a non-traditional model of real estate that mimics a traditional business model. Some publications he has been quoted in.

Feel free to ask him a question directly at [email protected] including a complimentary real valuation of your home.

or Create your MyHomes account today?